Profile of Muslims in Canada: Challenges & Opportunities

Profile of Muslims in Canada: Challenges & Opportunities

January 6, 2025

Population

-

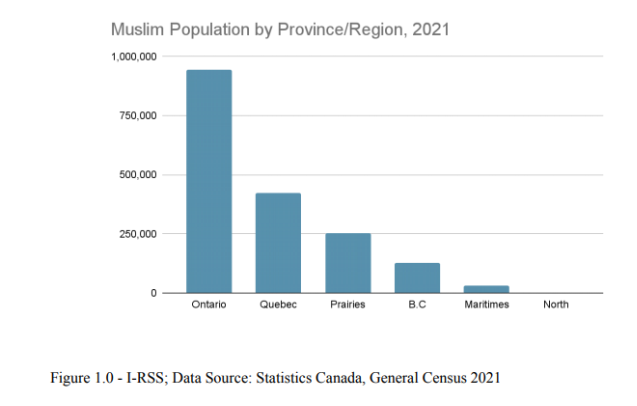

1,775,710 Muslims in Canada (2021) up from 1,053,945 in 2011.

-

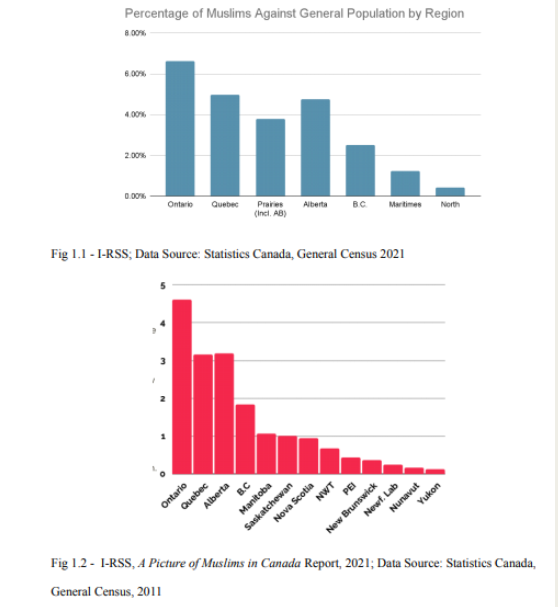

4.9% of the total national population, up from 3.2% in 2011.

-

Overwhelmingly urban.

-

Over half live in Ontario (53.1%, a slight reduction since 2011 indicating internal migration patterning).

-

Greater Toronto Area and Montreal, Ottawa, Vancouver, and cities in Alberta. Canadian North population is low (505 people) but did increase by 38.3% since 2011.

Immigration

-

Immigration:

-

1991-2001: 13.7% of all

immigrants were Muslims. -

2011: This rose to 18%.

-

2021 Census: 63.1% of total

Muslims being immigrants.

-

-

The majority of Muslim immigrants come from Asia (approximately 64.7%), especially Pakistan, Iran, Syria, Bangladesh, Afghanistan, India, Lebanon, and Iraq.

-

Significant numbers also come from Saudi Arabia, Turkey, UAE, Jordan, Kuwait, and Palestinian territories.

-

African-origin Muslim immigrants (29.1%) are from Morocco, Algeria, Somalia, Egypt, and Tunisia.

-

Smaller groups come from South America, the Caribbean, Europe, and Oceania.

High-Density Areas

-

GTA: Currently 10.2% of the total population and expected to rise to 13.2% by 2036 (StatsCan).

-

Quebec: Especially Montreal, which comprises 8.9% of the city’s total population.

-

Ottawa now replaces Vancouver as 3rd place, contending with Calgary and Edmonton.

Language and Diversity

-

Arabic: Most common mother language, followed by Urdu, Bengali, Persian, Somali, and Turkish.

-

Bilingualism: 95% of Muslims in Canada can converse in either or both official languages.

-

Visible Minorities:

-

89.2% of Canadian Muslims

identify as a “visible minority.” -

Over 60 ethnocultural groups are

represented. -

Dominated by South Asians

(37.6%), Arabs (32.2%), West Asians (13%), and Black Muslims

(11.6%, an increase from 9% in 2011). -

Indigenous Muslims: 1,840, up

from 1,065 in 2011, mainly female (58%).

-

Age and Cultural Identity

-

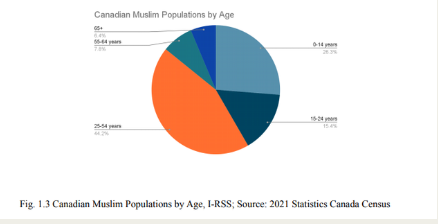

Young population.

-

31.5% were born in Canada, the US, or Europe (28% of that was Canada specifically).

-

“No Arab country ranks in the top three source countries of Muslim populations, by birth” (StatsCan 2021).

Education

-

60% of Muslims over the age of 15 have post-secondary education, including trade, college, or university (the latter being the largest).

-

44% of working-age Muslim men and women hold degrees, compared to only 25.8% of the Canadian national average.

Employment

-

13.9% unemployment rate among Muslims, higher than Sikhs, Hindus, and other minorities, but second to Indigenous communities.

-

12% self-employed.

-

Muslims earn up to 25% less than the Canadian national salary average, face lower pension incomes, and are overrepresented in rental economies.

-

Only 62% of Canadian-born Muslim professionals are employed in their trained fields.

Intersecting Challenges

-

Discriminatory hiring and retention practices.

-

Housing discrimination, lack of halal financing options.

-

High cost of living, with larger families facing added financial strain.

Halal Industry Growth

-

Halal Food Market Size: In 2022, the Canadian halal food market was valued at approximately $10.39 billion. Projections indicate that this market will reach around $18.34 billion by 2032, with a compound annual growth rate (CAGR) of 5.90% from 2023 to 2032.

-

Retail Expansion: Major grocery chains in Canada, such as Walmart, Costco, and Sobeys, have responded to the growing demand by stocking more halal-certified products, introducing halal store brands, and adapting existing products to meet halal requirements.

Canadian Grocer -

Consumer Perception: Despite the increased availability, a 2014 survey indicated that approximately 65% of halal food consumers felt that food companies and leading food chains were insufficient in meeting their halal demands, suggesting room for further market development.

Mosques / Islamic Centres in Canada

As of December 1, 2024, Canada is home to 755 mosques, reflecting the growth and diversification of the Muslim population across the country.

Provincial Distribution:

While specific data on the number of mosques per province is limited, the distribution of the Muslim population offers insight into where mosques are likely concentrated:

-

Ontario: With approximately 581,950 Muslims, Ontario has the largest Muslim community, suggesting a significant number of mosques, particularly

in urban centers like Toronto, which alone hosts over 100 mosques. -

Quebec: Home to about 243,430 Muslims, with a substantial concentration in Montreal, indicating a considerable number of mosques to serve the community.

-

Alberta: Approximately 113,445 Muslims reside here, with cities like Calgary and Edmonton hosting notable mosques, including the historic Al-Rashid Mosque in Edmonton, established in 1938 as Canada’s oldest purpose-built mosque.

-

British Columbia: With around 79,310 Muslims, the province has several mosques, particularly in the Greater Vancouver area.

Strengths of Canadian Muslims

-

Resilience and Adaptability: Despite systemic barriers, Canadian Muslims exhibit significant resilience. Initiatives to combat Islamophobia and promote youth empowerment indicate community-driven solutions.

-

Education and Skill Levels: High levels of educational attainment position Muslims as a vital intellectual and professional resource for Canada.

-

Cultural Richness: The diversity within the Muslim community fosters rich cultural exchanges and interfaith dialogue.

-

Youth Demographics: A young population offers potential for long-term contributions to Canada’s economic and social fabric.

Challenges Faced by Canadian Muslims

-

Economic Disparities: Persistent unemployment and underemployment undermine the economic stability of Muslim families, impacting future generations.

-

Limited Representation: Political underrepresentation and poor media portrayals restrict the community’s influence in shaping policies and public perceptions.

-

Lack of Cohesion: Cultural and sectarian differences, while a strength in diversity, sometimes hinder unified community initiatives.

-

Islamophobia: Systemic and social prejudices reduce opportunities and create barriers to full societal participation.

Additional Trends and Challenges

-

Issues parsing identities and navigating integration.

-

Economic precarity impacts Muslims sooner and harder due to systemic Islamophobia.

-

Schooling and education choices are constrained by Islamophobia and high costs of Islamic education.

-

Family wellness issues include mental health and kinship support.

-

Muslims report feeling isolated within their communities and broader Canadian society.

-

Lack of political representation and limited media visibility perpetuate stereotypes.

-

Community resilience and youth empowerment initiatives are growing but require greater support.

Sources:

-

Statistics

Canada 2021 -

Institute for Religious and

Socio-Political Studies

_________________________________________________________________________

Copyright

@ Justice for All. 27 E Monroe St Suite 700, Chicago, IL 60603